We have just released an upgraded set of tools: find out what’s new

Background

Since 2012, InsurEye has been supporting the travel industry with handy tools to analyze travel insurance coverage on credit cards. Throughout the years, we have been collecting feedback and ideas from our clients so we can continuously improve our tools. There are several changes that we are bringing to our clients. Most of them were driven by your feedback and wishes. Now, the updated platform is available to all our clients.

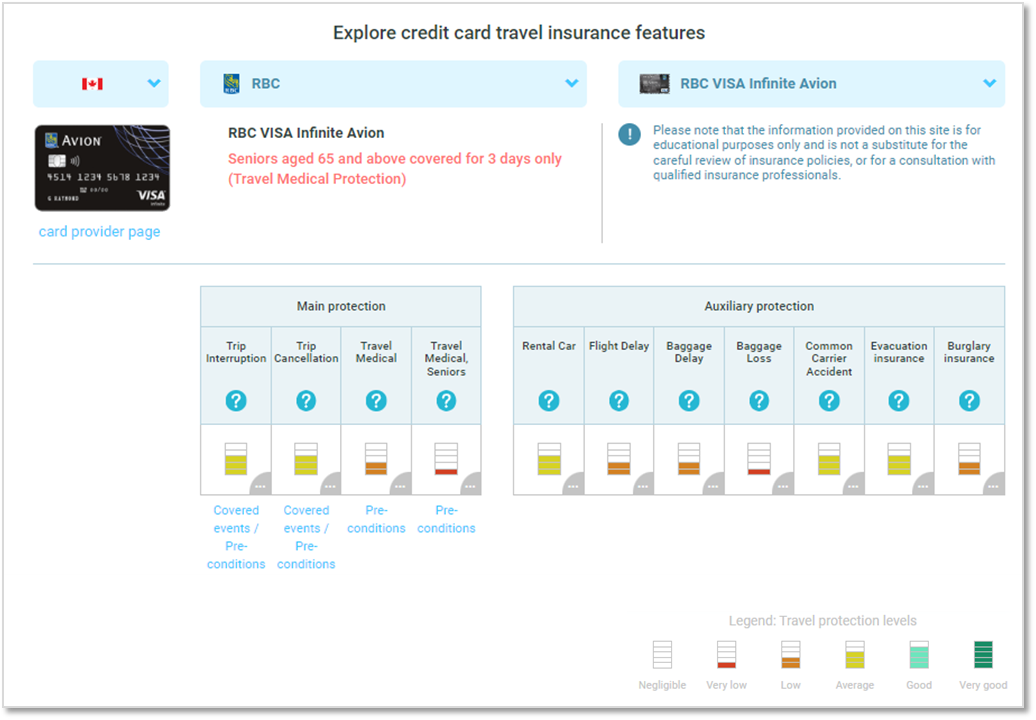

1. A more visual overview of travel insurance coverage on credit cards

In the past, our tool showed the presence of travel insurance protection with a green check mark (exist/does not exist). We have switched to a more visual way to show it by using coloured bars. This allows users to see, from the first glance, the level of coverage (e.g. travel medical coverage of $250,00 for three days is not the same as having travel medical coverage of $2,000,000 for 21 days). This allows travel advisors to not only understand if there is relevant coverage on a credit card, but to immediately see if it is sufficient. In the case of insufficient coverage, travel advisors can offer additional coverage.

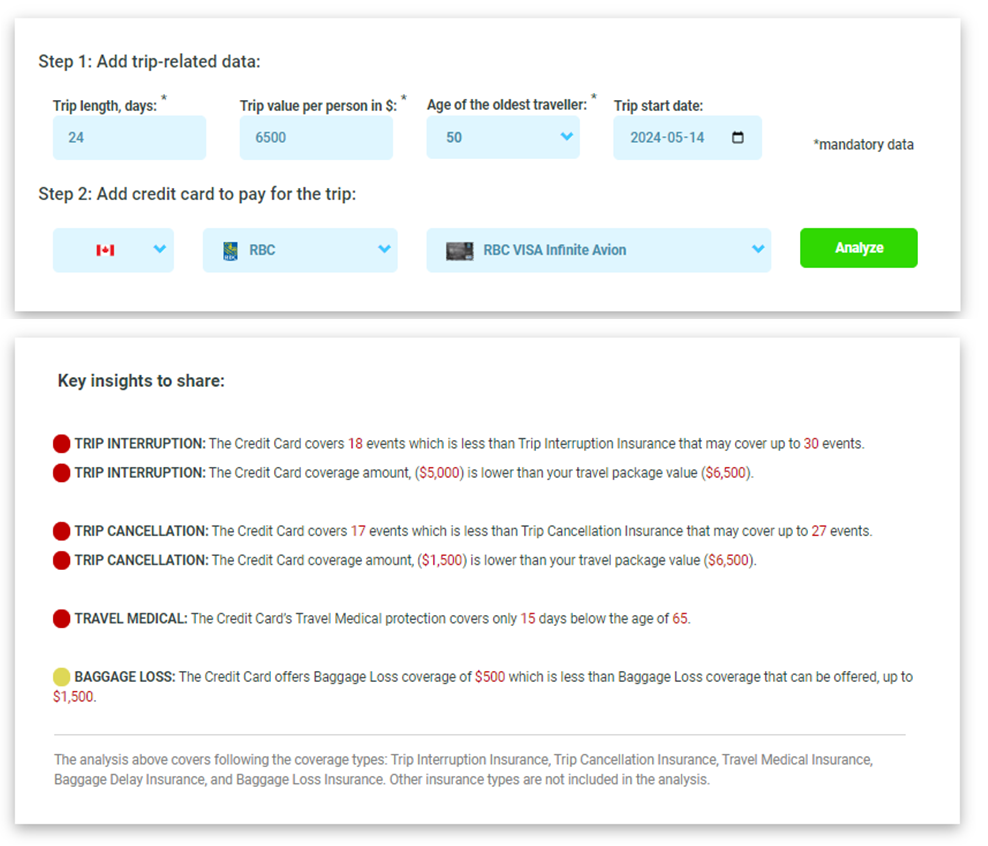

2. Functionality to analyze trip coverage by entering trip data

Many of our clients have been asking us to go a step further with our analytical tools and offer a trip-related insurance analysis identifying potential travel insurance gaps along with additional travel insurance sales opportunities.

That is exactly what our tool does! Once a few key trip data points are entered (e.g. trip length in days, trip costs, age of the oldest traveller), the tool uses its robust algorithm to identify potential risks where the upcoming trip is underinsured or not insured at all.

The tool provides a handy sales/client-tailored script to advisors in what to say to potential customers. This ensures that even if some travel advisors were not comfortable with selling travel insurance in the past, they are now able to provide expert guidance to their clients.

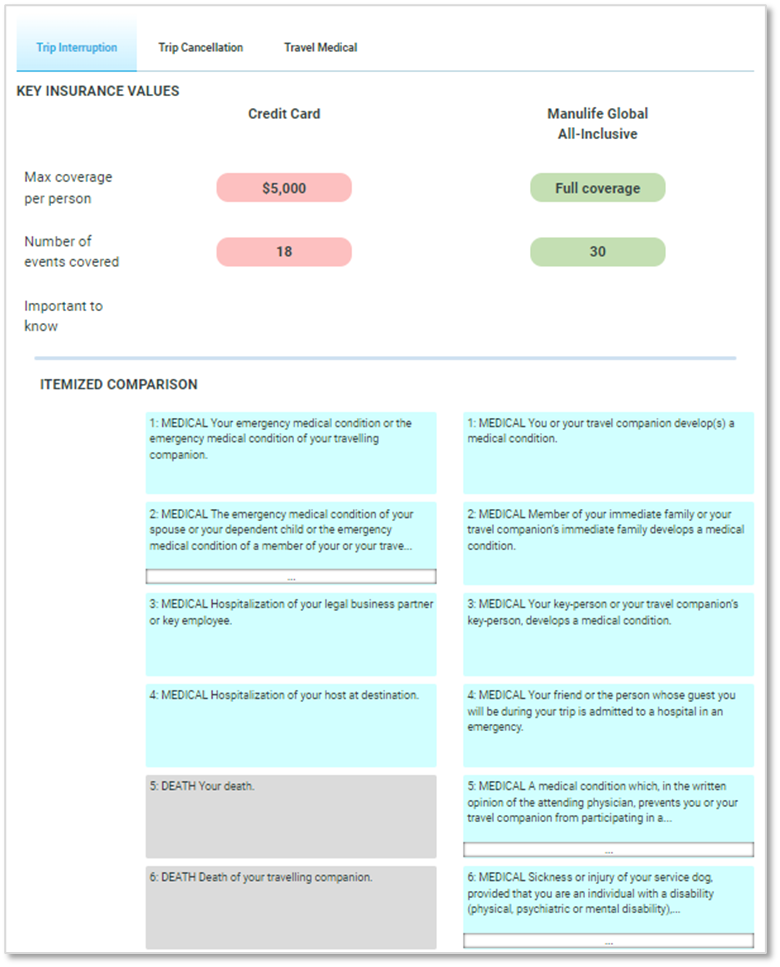

3. Detailed, event-by-event comparison for trip interruption and trip cancellation insurance

While many travel professionals are fine with the script our tool provides, some prefer diving even deeper into insurance pieces with trip interruption insurance and trip cancellation insurance. For these users, our new tool is capable of comparing potential risky events. Through a stacked, colour-coded representation, it is very easy to see that a particular credit card’s trip cancellation covers only two potential (typically accommodation and transportation) insurance events, whereas a travel insurance policy’s coverage spans six different events from the same category.

These insights equip travel professionals with additional knowledge for an effective discussion with potential clients.

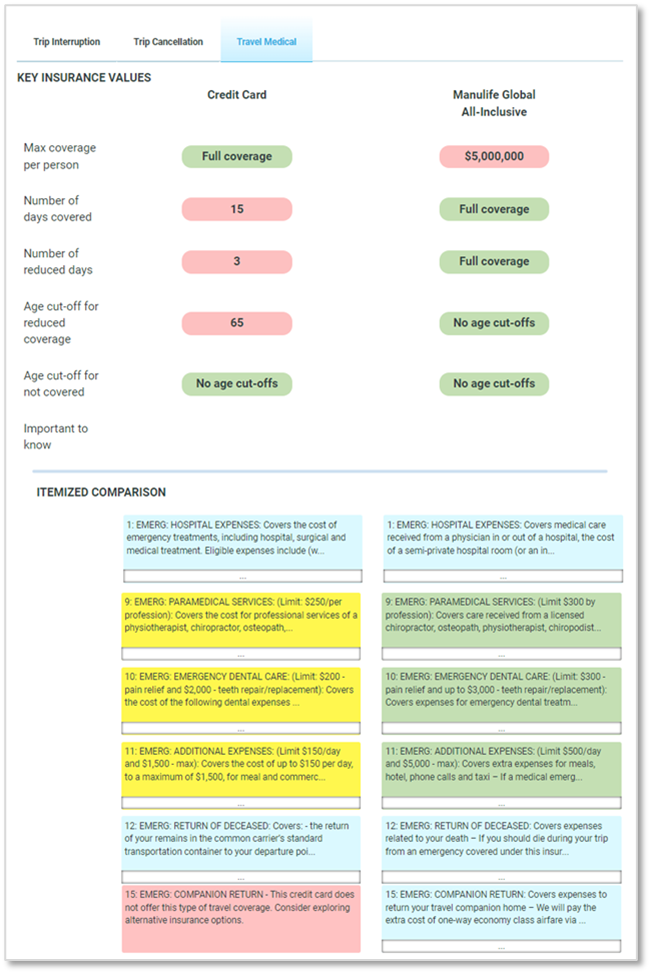

4. Detailed itemized comparisons for travel medical insurance, including a coverage heatmap

Travel medical insurance is, probably, the most complex component of travel insurance protection, so we went a step further to demystify it.

Our platform offers not only event-wise comparisons across 20+ travel insurance components, (e.g. emergency dental medical coverage or emergency air evacuation) but also compares them (where possible based on underlying travel insurance policies) from a coverage perspective. The result is a colour-coded heatmap allowing advisors to see, from the first glance, where the major differences are.

This information allows travel professionals to dive into an unprecedented level of travel insurance details that was reserved in the past for actuaries and claims adjusters.

Summary

Our new professional series tool, Travel Insurance Wizard, provides a unique and powerful set of insights to all travel professionals who are involved in travel insurance sales and analysis.

If you are interested and want to find out more, try out Travel Insurance Wizard yourself with no risk and zero obligations. Each of our subscriptions comes with a one-month trial and you can cancel your subscription, should you not be fully satisfied.

Leave a Reply