Travel insurance platform equipping your travel advisors with insights to increase travel insurance sales

Our travel insurance platform combines travel insurance insights from all relevant sources: travel protection that your clients might have on their credit card, travel insurance policies that your agency can offer (e.g. Manulife, Allianz, CAA Insurance, etc.), and various waivers offered by travel suppliers (e.g. Sunwing, WestJet, etc.). Any travel insurance advisor can use this information to advise clients about the best protection options and drive higher travel insurance sales.

DOING FOR YOU THE LEGWORK TO ANALYZE TRAVEL INSURANCE COVERAGE FOR EVERY TRIP

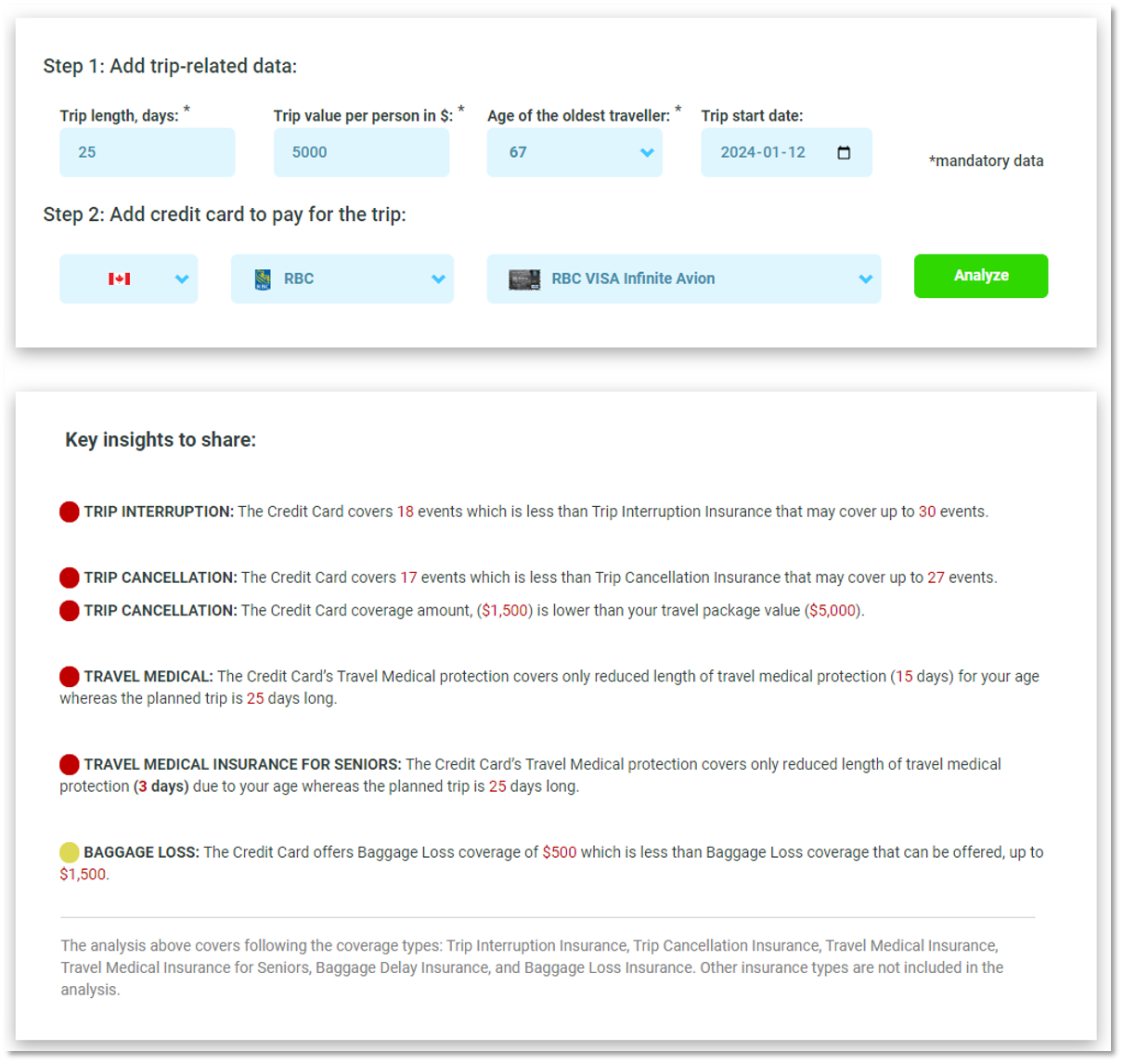

- Analysis of upcoming trip parameters (e.g. trip length, trip costs) and identified coverage gaps

- Indication of high and medium travel insurance risk areas

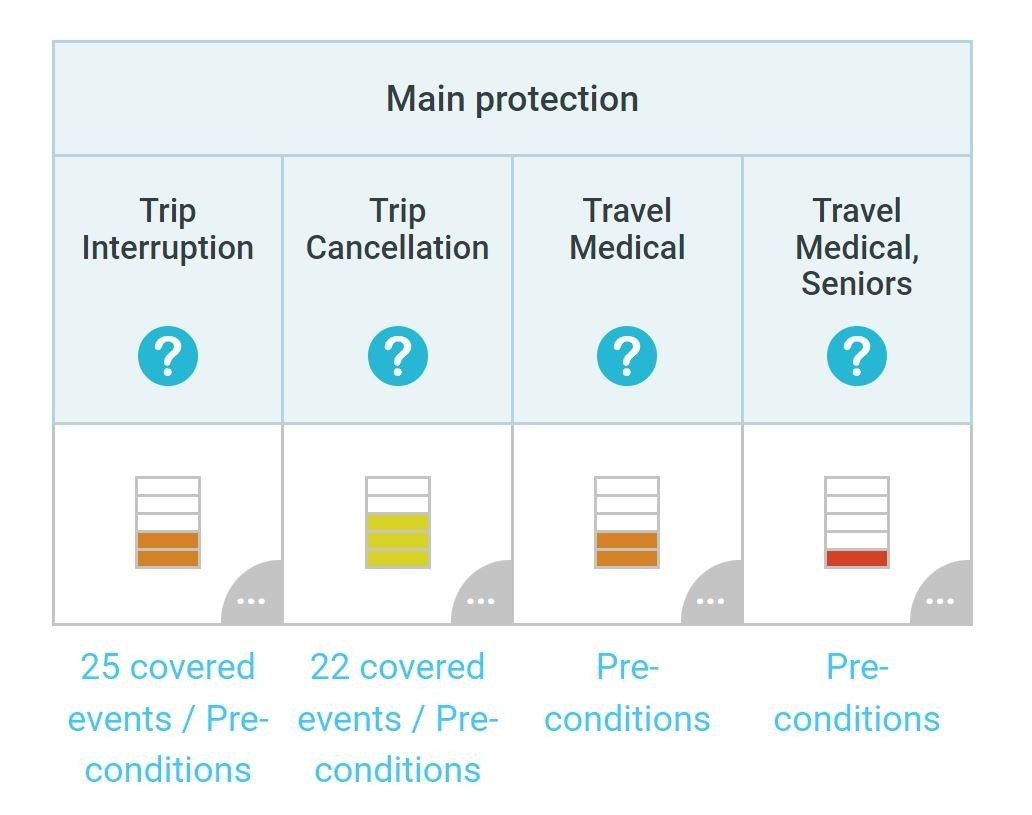

VISUAL AND EASY-TO USE

- A highly visual overview of all the travel insurance features on all credit cards

- Details of Trip Interruption, Trip Cancellation, and Travel Medical Insurance coverage

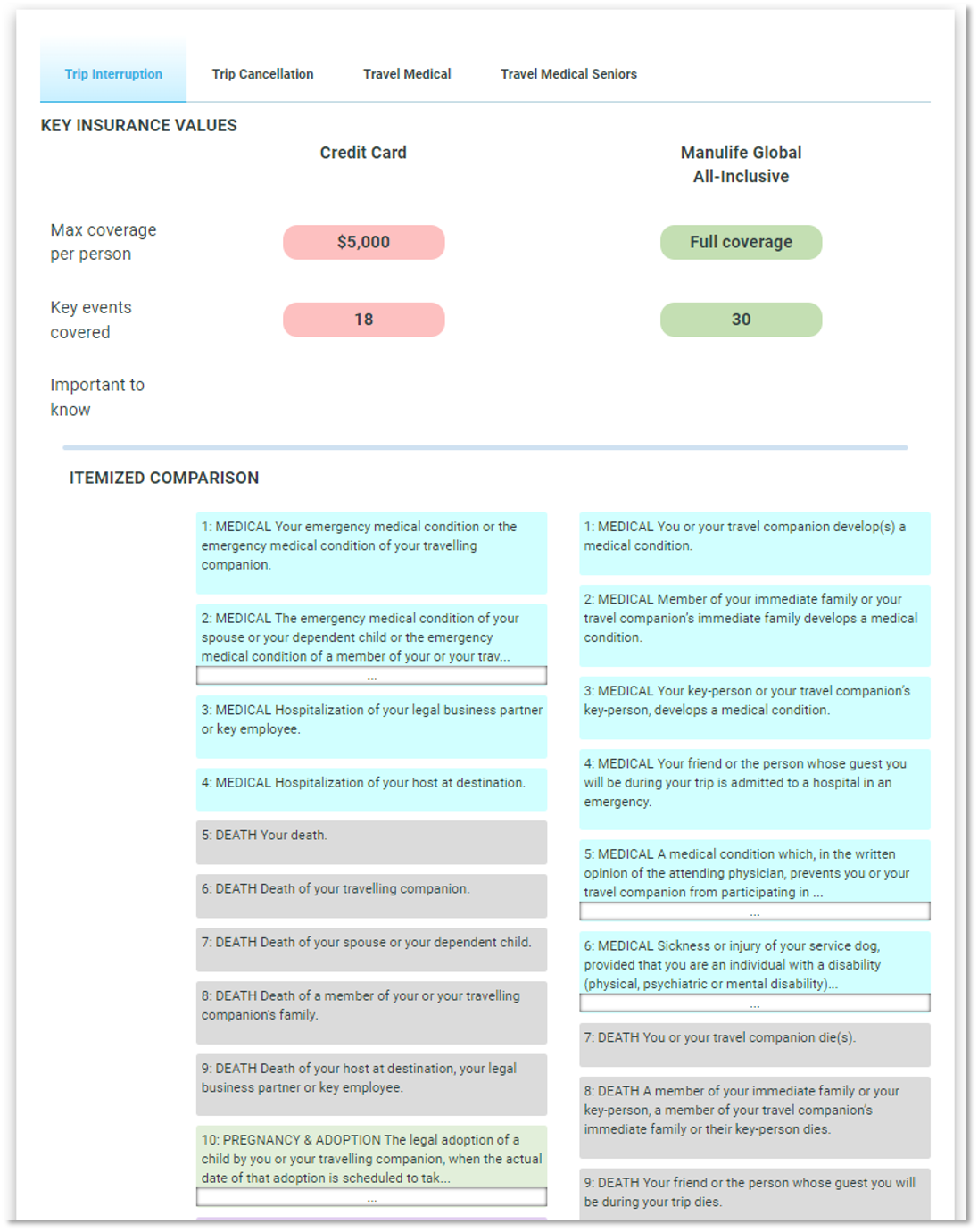

DETAILED COMPARISON OF ALL TRAVEL INSURANCE ELEMENTS

- Event-wise comparison between credit card travel insurance coverage and insurance policies from insurance providers for Trip Interruption and Trip Cancellation Insurance

- Analysis of all coverage elements for Travel Medical Insurance, e.g. hospital expenses, dental expenses, evacuation coverage, etc.

EACH OF YOUR TRAVEL ADVISORS CAN EXCEL IN SELLING TRAVEL INSURANCE

Most travel agencies divide their advisors into groups of those who understand insurance and are able to sell it and those who do not. With our platform, each and every one of your advisors will become a travel insurance sales champion.

Many of our clients assume they are covered on their credit card, but they’re not. Using Credit Card Navigator, our agents are able to correct the false assumption and ensure they are covered. Our most skilled insurance sellers start the insurance sales process by checking their card coverage.